The shareholder of a Georgian subsidiary is represented by the foreign company that decides to operate in a foreign market through this business form. Unlike the branch, this type of business form gives the foreign company the possibility to detach itself from the liabilities of its subsidiary. The foreign parent company will thus establish its presence in Georgia by incorporating a new company in the country.

| Quick Facts | |

|---|---|

| Applicable legislation (home country/foreign country) |

Foreign country |

|

Best used for |

Various activities (trading, commercial, services, etc.) |

|

Minimum share capital |

– |

| Time frame for the incorporation (approx.) |

1 week |

| Management (local/foreign) |

Local or foreign (the parent company is not required to appoint a local director) |

| Legal representative required |

No |

| Local bank account |

Yes |

| Independence from the parent company | Fully independent from the parent company |

| Liability of the parent company | No liability on the subsidiary's debts and obligations |

| Corporate tax rate |

15% |

| Possibility of hiring local staff | Yes |

Our agents in company incorporation in Georgia can offer more information on the differences between branches and subsidiaries and why it is recommended to choose one business form or the other. One of the advantages of the Georgian subsidiary is that this business structure is seen as an independent legal entity.

Table of Contents

Register a Georgian subsidiary in 2024

For the purpose of opening a subsidiary in Georgia, the foreign businessman must select a corporate entity prescribed by the Georgian law. In most of the cases, foreign investors will opt to register a subsidiary as a limited liability company. There are a few steps to complete when opening this type of company, starting with choosing the right and available business name (followed by the abbreviation LLC), opening a bank account and registering the limited liability company.

This type of company has at least one shareholder and it may be formed by appointing a single director. The main shareholder of a subsidiary will be its foreign parent company. The liability of the shareholders is limited to the amount of their contributions to theshare capital, this being one of the main reasons foreign businessmen choose toregister a company under an LLC.

The most important documents that need to be provided when opening a subsidiary are the documents belonging to the parent company; our team of consultants in company registration in Georgia can provide in-depth assistance on documents such as the articles of association, identification details of the company, information regarding the shareholders of the business and others.

Taxation of Georgian subsidiary

Considering that the Georgian subsidiary is incorporated for the purpose of developing commercial activities, it will be liable for taxation. From a taxation point of view, the Georgian subsidiary will be treated following the regulations available for local businesses and the investors will have toregister for a set of taxes, to which local companies are liable, as follows:

- • the subsidiary is required to register for value added tax(VAT), once the company reached a turnover of GEL 100,000;

- • this business form is also liable to corporate tax, which is imposed at the rate of 15%;

- • the company is also required topay withholding taxes for the payments transferred to non-residents;

- • the withholding taxes in Georgia are applicable to dividends, royalties and interests.

After the process of company formation in Georgia is completed and the legal entity is registered with the local authorities, the company’s representatives may also start the employment procedures, by hiring employees, who are taxed for their activities. The tax legislation available here requires employers to register the company’s employees for social security and other employment taxes and, in this sense, it is important to know that Georgia applies a personal income tax imposed at the rate of 20%.

What are the steps in registering a Georgian subsidiary?

The subsidiary in Georgia will generally take the form of a private limited company. Due to this reason, we will present here the steps investors have to take when incorporating a limited liability company. The legal procedure is started when the investor submit a formal application with the Public Registry, where they will submit the company’s statutory documents.

For a limited liability company, the company’s charter is necessary. The charter (or articles of association) has to contain specific information on the company that will gain legal personality, this being a mandatory step for company formation in Georgia. In this founding document, investors have to provide information on the following aspects:

- • the company’s trading name that is formally recognized by the Georgian institutions;

- • the legal entity under which the company is registered;

- • the address where the company has its headquarters (all companies in Georgia must have an official registered address);

- • the e-mail address created for the company and the company’s management structure;

- • personal information on the company’s shareholders or corporate details in the case in which the founder is another legal entity – as it is generally the case for the registration of a subsidiary;

- • if the founder is another company, the Georgian authorities will need information on the legal entity of the company, trading name, registration details, its identification code, its representatives and others.

When a subsidiary is registered as a limited liability company, the investors will have to present in the company’s charter details on the shareholding structure, the number of shareholders, the number of shares owned by each shareholder. The personal data of the company’s managers is also required.

Provided that the company is incorporated for a determined period of time, the charter has to mention the duration for which the legal entity will be active. Another legal requirement that has to be completed throughout the process of opening a company in Georgia is that the charter must be signed by all the company’s founders. More importantly, the document has to be notarized at a public notary in Georgia.

Please note that the Georgian legislation offers a more flexible option, in the sense that the company’s charter can be prepared in a foreign country where the founder is registered as a tax resident, but in this case, additional legal procedures have to be met. For instance, the document can be prepared by the officials of the said country, but it must be sent in Georgia as a legalized version.

Depending on the country, the document may also need to be apostilled. However, all documents sent from a foreign jurisdiction will need to be accompanied by an official translation made in the Georgian language and then a notarized version will also be necessary. Given the complex nature of this procedure, we invite you to address to our team of consultants in company registration in Georgia, who can advise on this matter.

What other documents are necessary for the process of company formation in Georgia?

In order to open a company in Georgia registered as a corporate structure, investors have to prepare additional documents than the ones we have presented up until now. The founders must add to the file a decision signed by all the company’s members on the registration of the legal entity. When the company is founded by another legal entity, the file has to contain the Certificate of Registration of the latter.

A document stating who will be the appointed director of the company is required, as well as a written consent of the director with regards to his or her new function. In order to provide evidence on the company’s official address, the investors have to add a rental agreement or other documents that show that the respective address is used as an official office space.

The file must contain evidence on paying the registration fee charged by the Georgian institutions as well. For more information on how to register a subsidiary here, our team of specialists in company registration in Georgia remain at your disposal and are ready to assist you in any matter concerning the incorporation procedure.

What are the basic differences between the Georgian subsidiary and the branch office?

Although the branch office and the subsidiary seem to have a set of similar traits, it must be observed that these two entities have substantial differences as well. There are differences with regards to the nature of the legal entity or the taxation system (in most of the cases the same taxes apply, with few exemptions) and these have to be well known prior to opening a company in Georgia, in order to take the best decision that is suitable for the investment plans of the foreign company.

Firstly, a subsidiary will be incorporated following the standard procedure for company registration in Georgia, which means that it will take the form of a legal entity which benefits from the status of a Georgian resident company. The branch office does not have a legal entity. Instead, it is considered to be a permanent establishment of the parent company abroad and this is why it is not recognized as a Georgian resident entity.

With regards to the taxation of these entities, investors must know that the legislation in Georgia does not require companies to complete a separate tax registration as a taxpayer in Georgia (when we refer to the value added tax registration), but you may find out more details on this subject from our team of consultants in company formation in Georgia. Both the subsidiary and the branch office are liable for the following:

- • the obligation to register for VAT once the company reaches a turnover subject to VAT of more than GEL 100,000;

- • the obligation to pay the corporate income tax, applicable at the rate of 15% (but here, the moment of taxation differs for each business form);

- • the obligation to pay withholding taxes at the rate of 5% for the taxation of interest and royalties;

- • the subsidiary and the branch office must pay withholding taxes for the compensation of international telecommunication and transportation services at a rate of 10%;

- • subsidiaries and branch offices acting as employers have to withheld from their employees the personal income tax, payable at the rate of 20%;

- • both are taxed with a rate of 18% for the VAT.

It must be noted that the subsidiary is liable for the payment of withholding taxes on the distribution of dividends, at a rate of 5%. When we refer to the payment of the corporate income tax, investors must know that the tax is collected when the income obtained from dividends is distributed amongst the beneficiaries (in the case of a subsidiary). The same tax is applied for a branch office at the moment when the company’s income is transferred to the mother company.

What are the new VAT rules?

In 2024, there are new tax rules that need to be observed by those who want to start a subsidiary in this country. For instance, one of the main changes is that if an investor has more than 1 company incorporated in Georgia, all these legal entities can be considered as a single entity for the purpose of VAT registration and payment.

Normally, a company needs to register for VAT when the turnover obtained in 12 consecutive months is of minimum GEL 100,000. In the case of companies that have the same ownership, the registration is mandatory when the overall turnover of all companies reaches GEL 100,000.

Does the Georgian subsidiary need a business license?

The need of having a business license will generally depend based on the economic sector in which the subsidiary will operate and its specific business activity. Companies dealing with broadcasting, oil transporting, banking, insurance, medical services will require the issuance of a business license, these being only few of the licenses prescribed by the Georgian law. You can request more information on how to apply for a business license in 2024 from our team of specialists in company registration in Georgia.

Are trademarks protected in Georgia?

Yes, companies operating in Georgia benefit from a legislative framework for the protection of a trademark or a patent. Thus, subsidiaries and branch offices registered here can register with the National Intellectual Property Centre. Businessmen who want to open a company in Georgia should know that the country is a signatory state of international agreements such as the Paris Convention, Madrid Protocol or the TRIPS Agreement.

In order to protect a trademark on the Georgian territory, a company must complete an application form with the above mentioned institution, which can be sent in an electronic format or by mail. Please be aware that the application must be completed in the Georgian language, so the assistance of persons native in Georgian might be needed. Also, the subject of an application should be a single trademark and not more.

The institution handles the registration of patents, trademarks, designs, copyright and other signs related to intellectual property. Our team of consultants in company registration in Georgia can offer in-depth information on how to register with this institution and can also provide legal advice on how to register with other authorities involved in the process of registering a Georgian subsidiary in 2024.

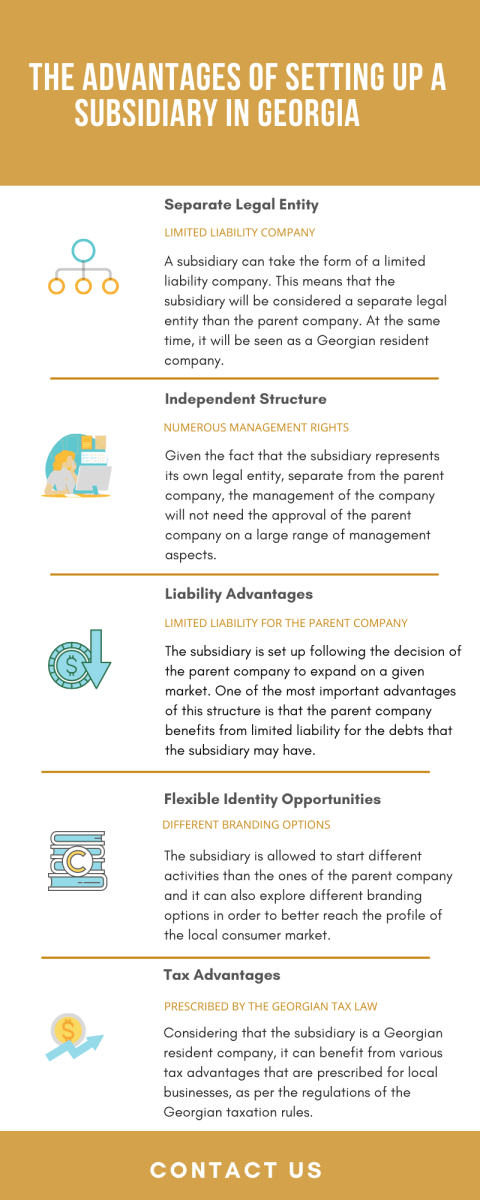

The advantages of a subsidiary in Georgia

The subsidiary provides certain advantages, but the decision of opening either a subsidiary, either a branch office should be based on a set of factors and more importantly, on the business plans the mother company has when expanding in this country. Investors must know that the registration of a branch office is simpler and it thus, can be completed in a shorter period of time.

Still, the advantage of a subsidiary is that is represents a more risk-free entity for the parent company, given that the subsidiary represents a separate legal entity, responsible for its own assets and liabilities (in the case of a branch this will not apply).

The subsidiary is also a preferred business structure when dealing with customer perception. Some customers and/or partners will show more confidence when working with a subsidiary company because the business is a Georgian legal entity, committed to the Georgian market and the Georgian Company Law.

If you have already decided what business form you want to open in this country, please contact our company formation agents in Georgia for more information regarding the necessary procedures. Our specialists can offer advice on the main advantages of operating here through a branch office or a Georgian subsidiary in 2024. If you need to open a company in other countries, such as Romania, you may contact our local partners.

If you do not want to operate through a subsidiary or you think it is not suitable for your business strategy, you can rely on us for the registration of a branch office.

In the case in which you want to open a company in Georgia through a branch office, our team can prepare the documentation (the parent company’s documentation must also be submitted as a part of the registration file).

Regardless of the way chosen to open a business in Georgia, you will be required to pay a registration fee. The value of the fee varies based on the type of registration you opt for.

In Georgia, investors have 2 options – the standard registration and the expedite registration and the fees charged are of GEL 100 or GEL 200 respectively. These fees are charged regardless of the company type you will register.

Once the company will become active, you can rely on us for the accounting and the bookkeeping of your business, which can be completed with the assistance of our accountants in Georgia.

Accountants are only those who have obtained a certification in this field and no other individuals can maintain the financial documents of your business, regardless if you operate through a small or large business.

Georgia has one of the simplest registration procedures at a global level, and this can be a major advantage when starting a subsidiary in 2024 in Georgia, as the bureaucracy is very reduced here. In fact, the country ranks as the 2nd global destination when we refer to the ease of company incorporation process. Overall, the country stands as the 7th global destination in the Doing Business Report, with a total of 83.7 points (out of total of 100).

According to the World Bank, Georgia also has very good scores when it comes to the steps for the registration of a property (the 5th place) and the rules created for the protection of the minority investors (7th place).

These aspects can also be of importance for those considering starting a subsidiary in Georgia in 2024. Georgia has good ranks for the enforcement of contracts (12th rank) and paying taxes (14th).