Among the available types of companies in Georgia, the limited liability company is the most popular legal entity selected by foreign investors in the country. The liability of the members of this type of company in Georgia is limited only to the amount of their contributions and this is an important advantage and one of the reasons why entrepreneurs choose opening an LLC in Georgia. The registration of a limited liability company in Georgia (abbreviated LLC) usually takes a couple of days and the investors must follow a series of steps in order to legally incorporate the company. Our company formation agents in Georgia can guide you through the incorporation procedure and help you open an LLC in Georgia.

| Quick Facts | |

|---|---|

| Types of LLCs |

One type – the limited liability company |

|

Most suitable for |

Most of the business activities and businesses operating as small and medium-sized companies |

|

Minimum number of shareholders |

1 |

| Maximum number of shareholders (if applicable) | 50 |

| Law regulating the procedure to open a limited liability company in Georgia |

Entrepreneurs Law of Georgia |

| Institution in charge with the registration of the LLC in Georgia |

The National Agency of Public Registry, operating under the Ministry of Justice in Georgia. |

| Director requirements |

No restrictions regarding the directors of the company. The LLC must have minimum 1 director. |

| Corporate taxes |

15% |

| Minimum requirements in order to open a limited liability company in Georgia |

A foreign investor can open a limited liability company in Georgia if the following are satisfied: – there is minimum 1 shareholder; – minimum 1 director; – the company has a registered address, a compulsory requirement for all companies; – the articles of association contain the necessary legal provisions; – the investors have set up a bank account (no minimum capital requirements are imposed). |

| Apply for a business number (yes/no) | Yes |

| Foreign ownership rules |

Foreign investors benefit from the same rules applicable to local citizens. There aren't any restrictions regarding the ownership of companies incorporated by foreign investors. |

| Who can register an LLC |

Local and foreign investors |

| Statutory documents of the LLC |

Articles of Association |

| Documents to prepare for the incorporation |

– application for registration; – identity documents of the founders; – the statutory documents, signed by the founders; – documents attesting the business premises where the company will operate; – proof of payment for the registration fee. |

| Audit requirements (yes/no) |

Yes, when reaching certain tresholds referring to the company’s assets, income and number of employees. |

| Corporate bank account (YES/NO) | YES |

|

Local business address (YES/NO) |

YES |

|

Name of a Georgian LLC |

Must be unique and contain the abbreviation L.L.C. or LLC (შპს in Georgian language). |

| Business permits and licenses | Depends on business activities (forestry, healthcare, banking, energy, oil & gas, etc.) |

| Liability |

Limited to the investments of the company, protecting the personal assets of its members |

| Incorporation time (approx.) |

3 – 5 days |

| Opening an LLC remotely |

You can set up a company in Georgia remotely, using a power of attorney. |

| Can hire foreign employees (YES/NO) |

YES, if the employees have the necessary working visa. |

| Withholding tax on dividends |

5% |

| VAT Registration | Only if the taxable annual turnover exceeds 100,000 GEL, companies are required to register for VAT. |

| Other taxes for LLCs |

– custom duties, – excise taxes, – property tax, – payroll tax, etc. |

| Company secretary |

Not mandatory |

| Advantages of opening an LLC in Georgia |

– limited liability, – simple process of company incorporation in Georgia, – asset protection, – dynamic business environment, – no minimum share capital, etc. |

| Assistance |

We can help you open a business in Georgia, no matter the company type. |

| Additional services |

– accounting in Georgia, – immigration, – real estate transactions, – contract drafting, – intellectual property rights, etc. |

Table of Contents

What are the characteristics of a limited liability company in Georgia in 2024?

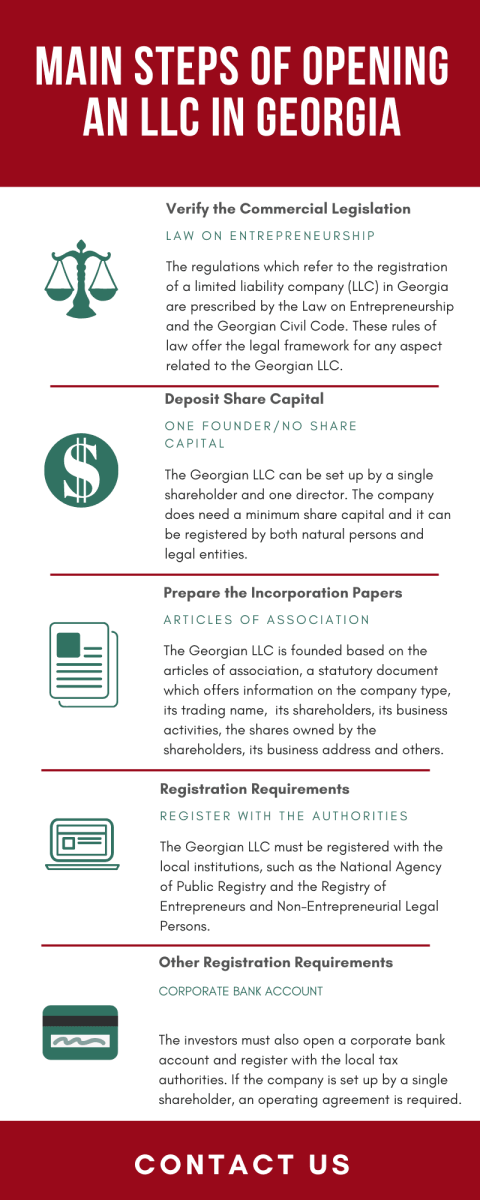

Businessmen who want to open a company in Georgia as a limited liability company should know that the main rules of law which apply to this business structure are the Civil Code and the Law on Entrepreneurship. Besides the fact that the shareholders benefit from limited liability, which is limited to the share of their investment in the company, this company type is characterized by the following as well:

- there aren’t any capital requirements imposed for opening an LLC in Georgia;

- the company’s capital has to be divided into shares which can’t be offered to the general public;

- the company’s founders (or founder) can be foreigners or local citizens;

- the company can be set up by natural persons or by other legal entities;

- the limited liability company in Georgia can be registered with only one director;

- the details of the company’s shareholders and directors have to be made public;

- it is legally required to have an official business address in Georgia for the limited liability company.

Besides these, the limited liability company in Georgia can appoint a company’s secretary, but this procedure is not compulsory. This company type must also submit tax returns following the accounting requirements available in Georgia and it must appoint an annual general meeting; our team of specialists in company registration in Georgia can provide more information on other characteristics of this business form and the procedure of opening an LLC in Georgia.

The registration of a company in this country is concluded through the National Agency of Public Registry, an institution which operates under the Ministry of Justice. Once registered here, the company will receive an identification number and extract issued by the Registry of Entrepreneurs and Non-Entrepreneurial Legal Persons. This extract can also be obtained through the online platform on the National Agency of Public Registry, where all types of companies, including the Georgian limited liability company, can request this document.

The first steps for opening an LLC in Georgia in 2024

The first step and also a decisive one is naming the company. A company name should be chosen according to the business owner’s wishes, but only if that name is available. The name of a Georgian limited liability company will also contain the abbreviation L.L.C. or LLC.

There are special restrictions that apply to the usage of words or already existing names, such as those referring to existing state agencies. The name of the company is important, it defines the business and helps the customer identify the company. Business owners should check the availability of a business name and they should also secure a domain name for their future business.

Necessary documents for opening an LLC in Georgia

The limited liability company in Georgia is founded based on the articles of association. This document includes: the name of the company, the name and address of its members and any additional information regarding the types of activities that the company will develop in Georgia. Besides these, the articles of association should also include the below mentioned provisions:

- the selected legal entity of the company – in this case, the limited liability company;

- the registered address of the company and the specimen signatures of the company’s founders;

- the structure of the company’s management body and the rules regarding the decision making process;

- the shares owned by each shareholder (the company can also be formed by a single shareholder);

- the duration for which the company is set up (if this applies, the duration will be expressed in years).

A transmittal form must also be submitted with the articles of association. Limited liability companies in Georgia that have only one member must also create an operating agreement. This is a document that states the ownership and operating procedures for the company.

Further requirements for a LLC in Georgia include obtaining an employer identification number that will be used for opening a bank account, for taxation purposes and also for hiring employees. Every LLC in Georgia will have to comply with the exiting requirements for annual filings and other taxation principles. Depending on the business sector, additional special permits and licenses may be required.

Requirements for a minimum share capital in Georgia

The limited liability company in Georgia has no requirements for a minimum share capital. The founders can each bring their own contributions. The authorized capital of the Georgian limited liability company can have any amount. This is the most frequently used type of company in Georgia.

The joint stock company is another business form in Georgia that does not require minimum share capital. However, in this case the authorized capital is divided into shares. The founders can decide upon the minimum nominal value of the authorized capital.

The capital of a company is defined as that institution’s monetary fund, the net worth and possession. The subscribed share capital represents the amount considered necessary to establish an institution. It is described in that company’s bylaws.

What are the tax considerations for companies in Georgia?

Being registered with the purpose of developing commercial activities, companies in Georgia, including the limited liability company, are liable to a set of taxes. In the case of a limited liability company, the taxation will be done based on the corporate tax system, unlike the sole trader, which is taxed based on the personal income tax regulations. When referring to taxes, Georgian legal entities are charged with the following:

- the corporate tax – charged at a rate of 15% on the company’s distributed dividends;

- withholding tax on dividends – charged at a rate of 5% for the dividends paid to non-residents;

- the value added tax – the company is required to register once its turnover is above GEL 100,000;

- the value added tax in Georgia is imposed at a rate of 18%;

- the withholding tax on royalties and interest is applied at a rate of 5%.

If you want to open more than just one business in Georgia, please know that starting with 2024 you will have to comply with new VAT registration requirements.

As mentioned above, the VAT registration steps are mandatory when the company reaches the threshold of GEL 100,000, but if you are the owner of more legal entities, the VAT registration will become mandatory when all your companies, together, reach this threshold in a period of 12 consecutive months. Consequently, you will need to register all your legal entities for VAT, regardless of their individual turnover.

What are the withholding taxes in Georgia in 2024?

The rates on withholding taxes in Georgia for 2024 are applied at the same rates as the ones mentioned above, but such rates can vary based on the whether the recipient is a tax resident of country with which Georgia has signed a double tax treaty. For non-treaty countries, the withholding taxes on interest, royalties and dividends are charged at a rate of 5%, while the rates for the same parts of income can be charged with 0%, 5% or 10%, depending on the provisions of each treaty.

A limited liability company in Georgia will be liable for the payment of the corporate tax (or the profit tax) if it is registered in this country, but also if it is set up as a non-resident company which develops a commercial activity on the Georgian territory. Companies can also be charged with excise taxes, and they can apply if the legal entity is a producer of excisable products, an importer, an exporter or if it delivers gas for vehicles.

Please note that Georgia provides several economic free zones and if a company it is registered in one of the country’s free zones, a set of tax exemptions can apply. For example, there is a full exemption on the corporate income tax if the company is set up in a free industrial zone. The exemption is also applicable to the value added tax, the property taxes or the customs duty; further information on other tax benefits available in this case and the procedure of opening an LLC in Georgia can be presented by our team of specialists in Georgian company formation.

Our company incorporation representatives in Georgia are ready to help you with all the steps needed for incorporating and registering a company in the country. You can call our office in Tbilisi to find out more about our offers; investors can also receive in-depth information on the types of services we can provide when opening an LLC in Georgia.

You can call our team if you are interested in the steps you must follow in order to open a company in Georgia. Our consultants can help you obtain any business permits or licenses that may be required for your business field.

You can also rely on us for the formalities that you must respect once you will hire employees, regardless if they are Georgian nationals/residents or foreigners.

In the case in which you will open a business in Georgia that will hire foreign workforce, it is legally required that your future employee arrives here under a suitable visa, that allows the person to work in this country.

Usually, the employers must provide different documents showing that there person will have a type of employment contract that allows the issuance of a work visa.

When you will hire employee, your company will have to complete specific payroll procedures (calculating the employment taxes, paying the salaries, providing other employee benefits, etc.).

These will be done only with the assistance of accountants in Georgia, as payroll is part of the accounting system of a company. You can rely on our team of consultants for this service.

Investors can find many business opportunities when starting a company here in 2024, regardless of the legal entity of choice. Georgia has a strategic geographical location and provides a stable economic market with an attractive tax system (only few taxes, that have been maintained the same in the last years).

At a global level, Georgia has certain advantages, when we refer to the ease of doing business (the incorporation procedure is very simple and straightforward) – for this, it has a score of 99.6 (from a maximum of 100 points). A score of 92.9 is granted for the steps concerning the registration of a business. At a global level, Georgia stands as the 7th most attractive country for doing business. The company registration costs are also low, including for an LLC (GEL 100 or GEL 200 – the latter is available for expedite registration services).

If you need further details as to why Georgia is an attractive business destination, our consultants remain at your service.