Georgia has a standard VAT rate of 18% that applies to certain taxable transactions, depending on the business field and the commercial activity of the Georgian company. The value added tax (VAT) is just one of the applicable taxes for companies in Georgia and certaintaxpayers in the country must be registered for VAT purposes. The registration for VAT can be voluntarily and it is also compulsory in certain cases. Our specialists company formation in Georgia can help you register your company for VAT purposes.

| Quick Facts | |

|---|---|

| We offer VAT registration services | Yes, our specialists offer VAT registration. |

|

Standard rate |

The standard VAT in Georgia is 18%. |

|

Lower rates |

Not applicable |

| Who needs VAT registration |

Entities that obtain an income from the sale of goods and services in Georgia, importers of goods, non-residents who trade goods in Georgia and who aren't registered for VAT in Georgia. |

| Time frame for registration |

Within a day, for the online procedure. |

| VAT for real estate transactions |

18% |

| Exemptions available |

VAT in Georgia is not applied to: – financial services, – goods and services for oil/gas operations, – some medical services, – some educational services, – tourist services for foreigners etc. |

| Period for filing |

On a monthly basis |

| VAT returns support | Yes |

| VAT refund |

Entities entitled to VAT refunds can receive the refund automatically, in situations where the amount estimated was above the amount due, or they can complete a form with the Revenue Service and request to receive the VAT. |

| Local tax agent required |

Not required |

| Who collects the VAT |

The Georgian Revenue Service |

| Documents for VAT registration in Georgia |

– the application form of the Revenue Service, – the date at which the registration is required, – the reasons for registration, – company documents, – whether the VAT in registration in Georgia is done voluntarily or mandatory (mandatory registration is imposed when a company reaches GEL 100,000 as a taxable turnover in the last 12 months). |

| VAT number format |

Tax Identification Number (TIN) is comprised of 9 digits for legal entities. Non-residents are assigned with a 9 digit TIN as well, while Georgian companies liable to taxation are issued with a 11 digits TIN. |

| VAT de-registration situations |

VAT registration in Georgia can be cancelled when: – a company enters the liquidation procedure, – when a certain individual from the company dies, – in case of non-performance of a business (not collecting sufficient taxable amount to qualify for VAT payments). |

| Threshold for mandatory VAT registration | When the taxable turnover reaches GEL 100,000 in a period of 12 months. |

|

VAT exempt goods |

Certain medical products/services, certain education services, financial services, etc. |

|

VAT obligations for foreign online businesses |

Online businesses (registered in Georgia or developing business activities in Georgia) are VAT payers in accordance to the Georgian tax law. |

| VAT exemption registration for companies | Companies are exempted from VAT registration when they operate as micro-businesses. |

| Tax legislation |

The Georgian Tax Code |

| VAT obligations for digital services providers |

VAT registration in Georgia for digial services providers is mandatory starting with 2021 (it includes non-resident companies). |

| Types of digital services charged with VAT |

Telecommunication services, broadcasting services, electronically supplied services |

| Establishing the place of supply for digital services providers |

VAT registration in Georgia is mandatory if the place of business is determined to be any of the following: – the service recipient is located in Georgia; – the IP address of the buyer’s device, who purchased the digital service, is registered in Georgia; – the operator of the financial transaction through which the digital service was bought is located in Georgia; – the telephone code through which the purchase was made is a Georgian number. |

| Currencies accepted for the payment of VAT |

GEL, EUR, USD |

| Ways to register for VAT | VAT registration in Georgia can be completed online. |

| When can a entity deduct VAT? |

A legal entity can deduct VAT if the company’s activities are regulated under the Article 172 of the Georgia Tax Code. |

| When is VAT calculated to a good/service? |

At the moment of the supply, in most cases. |

| Other types of business taxes charged in Georgia |

customs duty, excise tax, corporate tax, property tax |

| What type of tax is VAT? |

An indirect tax, charged in various steps of production/sale of goods/products. |

| Ways in which our consultants can assist you |

Our consultants can prepare the VAT registration file and can complete the procedure on your behalf. Additionally, you can rely on us for professional accounting services and tax compliance and assistance. Our team can provide any other services related to taxation in Georgia. |

Table of Contents

What is the VAT registration procedure for foreign companies in Georgia?

Starting with January 2021, foreign companies performing activities that are charged with the VAT in Georgia must comply with new registration and reporting formalities.

The regulations are applied to foreign companies that render digital services to the Georgian market. The regulation was introduced by the Georgian government, with the purpose of aligning its tax policies with the European Union (EU) policies.

Although Georgia is not a member state of the EU, it has signed an association agreement and the new tax law aligns with the EU’s VAT Directive 2006/112/EC.

As per the Georgian tax legislation, a foreign company can have VAT obligations in Georgia in the following scenarios:

- the foreign entity is a taxable entity;

- the entity does not have a business residence in Georgia;

- does not have a permanent establishment in Georgia;

- it delivers digital services to entities who are considered to be natural persons and who are not VAT registered tax payers.

Businesses that fall into these criteria must complete a registration form, which will be submitted with the Revenue Service of Georgia. The procedure can be completed online.

The more exact name of the form is the “Foreign Taxable Person Registration Form” and it must contain information regarding the following:

- the country of residence, where the foreign company is registered for tax purposes;

- the business activities carried by the company (the main business activity);

- the tax identification number issued for the company by the authorities of the country where the company is a resident.

When are foreign digital companies liable to VAT in Georgia?

VAT is charged in the place where the transaction occurs. However, for digital services, the definition had to be established under specific terms, given the fact that digital services are not tangible products.

According to the new law, a foreign company is liable to VAT payments in Georgia when the place of place of delivery is any of the following:

- the service recipient has his or her residency in Georgia;

- the network address that was used for the purpose of buying the respective digital service provided by the foreign company is located in Georgia;

- the telephone used for purchasing the service has a telephone code that belongs to Georgia;

- the bank account used for the purchase of the service is opened at a financial institution operating in Georgia;

- the payment service platform used for the purchase of the service is registered in Georgia.

What are the VAT reporting obligations for foreign companies in Georgia?

If you want to open a company in Georgia or if you own a foreign business that has tax obligations in Georgia, the obligation to complete reporting formalities will also arise.

Foreign companies must submit VAT reports based on a quarterly system (that implies that a VAT report must be prepared every 3 months, resulting in 4 VAT reports). The quarters are divided as follows:

- 1st quarter (1 January – 31 March);

- 2nd quarter (1 April – 30 June);

- 3rd quarter (1 July – 30 September);

- 4th quarter (1 October – 31 December).

The formalities are completed with the same institution where the company completed the VAT registration procedure, meaning the Revenue Service of Georgia.

It is mandatory to prepare and submit the required documents no later than the 20th day of the next month after the end of the quarter. Foreign companies have 3 options with regards to the preferred currency of payment, as follows:

- Georgian Lari (GEL);

- Euro (EUR);

- Dollar (USD).

Please mind that although in numerous countries foreign companies have to appoint a fiscal representative, Georgia does not apply this rule for foreign digital services providers.

VAT registration in Georgia for local businesses in 2024

A company in Georgia can become a VAT payer if it is registered voluntarily for this purpose or if its activity falls into the category of businesses that must register for VAT purposes.

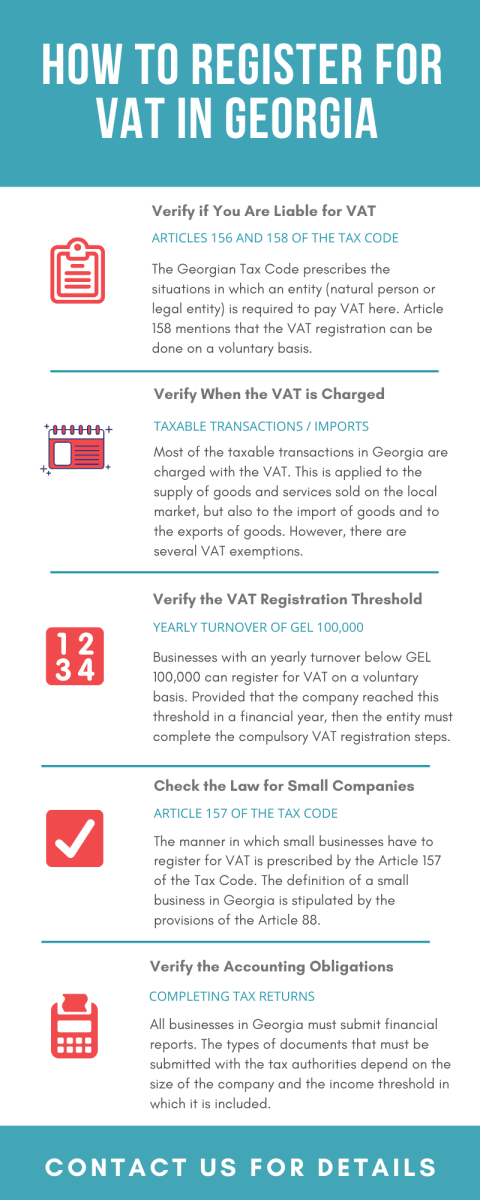

Compulsory VAT registration is required for taxpayers who, in a period of 12 months, perform economic activities that have an accumulated value of VAT taxable transaction that exceeds GEL100,000.

This is also required in the case of businesses that are involved in the production or the import of excisable goods and products into Georgia, but also in the case of businesses operating here after a reorganization.

The VAT registration in Georgia can also be done on a voluntary basis. This is applicable in the case in which a business has a yearly turnover with a value below GEL 100,000. The requirement for VAT registration is also applicable for companies that are involved in trading excisable goods into Georgia.

Besides these, entities that conclude a single economic activity, carried out for a short period of time, even for a day, that has a value of minimum GEL 100,000, must also register for VAT in Georgia. Investors can request additional information on the VAT registration in Georgia from our team of specialists.

Starting with 2024, companies must comply with requirements for VAT registration in Georgia. The VAT registration threshold has been maintained at the same value (GEL 100,000), but there are new regulations for companies that have the same ownership.

Provided that a local or foreign investor has more companies, the obligation to register for VAT will now appear when the overall turnover of all companies is of GEL 100,000 in a period of 12 consecutive months, and not when one company reaches this threshold.

Under the new legislation, all companies will have to register for VAT regardless of their individual turnover and they will need to comply with mandatory VAT registration formalities, as they will be considered VAT payers.

In Georgia, the taxable amount of VAT is calculated based on the value of transaction. As a general rule, the VAT that needs to be charged is calculated taking into consideration the market value of the respective goods or services that are sold on the local market.

It is also important to know that the VAT has to be calculated into the shelf price of goods sold in Georgia.

For the purpose of VAT registration in Georgia, those involved in temporary imports will need to apply a VAT of 0,54% (calculated on the taxable amount) for each month in which the goods are stored on the Georgian territory.

Please mind that the rules on VAT registration in Georgia have been modified starting with 1st of January 2021; here, all companies should know that businesses registered in Georgia that have made purchases from non-Georgian based businesses will be charged with the reverse VAT.

This applies to purchases of goods and services, and they will be taxed with the standard VAT rate of 18%; our team of consultants in company formation in Georgia can provide more details on the amendments of the 2021 tax law.

What are the VAT obligations for Georgian small businesses in 2024?

Businessmen who want to open a company in Georgia categorized as a small business have to comply with several requirements.

Thus, when a company that is represented by a natural person is considered a small business and when the company becomes liable for the payment of the VAT, the businessman has to register as per the provisions of the Article 157 of the Tax Code.

Also, the company is required to register its inventory balance available at the moment when the company became liable for the payment of the VAT in 2024.

A natural person interested in opening a company in Georgia as a small business must know that this term is defined under the Article 88 of the Georgian Tax Code, which stipulates that this can be acquired only when the said company has a maximum gross income of GEL 100,000 during a financial year.

With regards to the accounting requirements that must be met by a small business, the Article 91 of the Tax Code stipulates that, at the moment when the company must apply for VAT registration in Georgia, it must maintain its accounts following the stipulation of the Code.

When referring to a micro-business, the status can be granted as long as the company has an yearly income of minimum GEL 500,000 (there are different tax rates based on whether the company has an income below GEL 500,000 or above). Please note that if the entity, represented by a natural person, conducted the steps for VAT registration in Georgia, then the status of micro-business can’t be obtained.

The manner in which micro businesses and small business have to complete their tax obligations throughout a financial year is prescribed under the Article 93 of the Tax Code.

Thus, tax returns, including VAT returns, where applicable, need to be filed with the local authorities no later than 1st of April of the following financial year.

It is also necessary to know that at the moment when the company ceases its financial activities, the tax authorities require the company’s owners to submit their tax returns in a period of 30 working days since the company was closed down.

Our team of consultants in company formation in Georgia can offer extensive information on the procedures involved when closing down a business.

Taxable transactions in Georgia

Certain activities are regarded as taxable transactions and they are subject to the 18% VAT rate.

This is applied to most of the goods and services traded on the Georgian market and our team of consultants in company formation in Georgia can offer in-depth advice on any matter related to the payment of the VAT. This VAT rate is applied to the following:

- the supply of goods or services produced and delivered on Georgian territory;

- the transfer of goods and services for non-economic purposes (if the taxpayer has a VAT credit for these goods or services);

- the transfer of goods or services in exchange for shares in a Georgian legal entity or partnership;

- the supply of goods or services by a taxpayer to its employees;

- the export of goods outside Georgia and the import of goods into Georgia.

The standard VAT rate in Georgia is 18% for all imports and taxable transactions, unless otherwise defined in a specific agreement or provision.

Some transactions are exempt from the tax without the right to reclaim input VAT. Our company incorporation agents in Georgia can give you complete details regarding the VAT obligations for each business activity.

When is VAT applied in Georgia?

At the level of 2024, the Georgian VAT is charged to taxable transactions in given moments. For example, in the case of the imports of goods, the VAT is charged on the customs value of the goods declared by the importer.

The customs value is calculated taking into consideration the economic value of the goods, the value of the transportation, the customs duties and the excise tax (if applicable), as per the customs legislation available in Georgia.

According to the country’s Tax Code, the VAT is chargeable on a taxable transaction at the moment in which the supply of goods takes place. Several exemptions are allowed and our team of consultants in company registration in Georgia can provide an extensive presentation regarding this aspect.

Businessmen who want to open a company in Georgia should also know that the Tax Code prescribes that the payment of the VAT is imposed to any taxable transaction that occurs on the country’s territory, unless there are specific exemptions that are applicable.

In the cases in which the transaction occurs between two parties located in different countries (in Georgia and another jurisdiction), the place of the taxable transaction should include the following:

- the place of registration where the recipient is a tax resident;

- the place of management declared by the recipient or the location of its permanent establishment;

- the regulations are also available for the supply of services (also referred to as intangible assets);

- intangible assets can refer to consulting services, engineering, legal or accounting services, advertising, but it can also refer to telecommunication, radio or television.

When should a company issue a VAT invoice in Georgia?

Companies registered for VAT purposes in Georgia must issue specific documents regarding the supply of goods or services delivered here. In this sense, it is legally required to issue VAT invoices to the company’s clients in a period of maximum 30 days.

This is a document that is strictly regulated by the Ministry of Finance in Georgia, which provides an evidence on the financial transactions that are charged with the VAT.

Are there any other important matters concerning the Georgian VAT for 2024?

Yes, the legislation concerning the VAT is extensive and covers a wide range of matters. Our team of specialists in company formation in Georgia can offer in-depth information related to the overall tax legislation applicable to the payment of the VAT. However, it is necessary to know the following matters:

- according to the provisions of the Tax Code of Georgia, the VAT does not apply to hired workforce (Article 16.2).

- Article 57 of the same rule of law stipulates that, in the case in which a person is a heir of another person who has conducted a business activity in Georgia and who was a VAT taxpayer, but who passed away, the said person will become a VAT payer, provided that he or she will continue the company’s economic activity;

- a heir of a business charged with VAT is entitled to obtain VAT deductions, provided that he or she can prove this right through various company documents;

- overpaid VAT can be refunded to a taxpayer if certain conditions will apply.

VAT refunds in 2024 can be obtained on the amount of overpaid VAT in a period of one month since the day in which the taxpayer filed an application (Article 63) in the situation in which the party exported, purchased or imported fixed assets that fall under the definition of the Article 111 of the Tax Code.

The same applies if a company purchased various goods useful for manufacturing fixed assets included in a specific category (Group IV of the Article 111).

Who is liable to the payment of VAT in Georgia in 2024?

There are multiple categories of entities that are liable to the payment of the VAT. The Section VI of the Tax Code stipulates who the tax payers are and when the VAT registration in Georgia should be done as a mandatory procedure.

Article 158 mentions that the registration for VAT purposes can also be done on a voluntary basis and the applicant will gain the VAT payer status once the application forms are submitted with the local tax authorities.

As a general rule, the obligation to pay VAT in this country will arise in the case of entities that are registered for VAT purposes or of those who have applied for VAT registration in Georgia.

At the same time, the regulation is available for companies and other parties involved in the import of goods into this country and to non-residents providing various types of services here. Article 156 offers the legal framework with regards to the obligation to pay VAT in Georgia.

What types of taxes are applied in Georgia?

For those opening a company in Georgia, the legal and the tax systems can be rather complicated, especially when investing here for the first time. However, it is necessary to know that the Georgian legal framework resembles in many ways with the legal systems available in European countries.

More than this, it is necessary to know that the local authorities have introduced new rules of law that are in line with the ones applicable in the European Union (EU). With regards to the local tax system, it is important to know that the country charges the following taxes:

- the standard rate of VAT in Georgia is of 18%, but specific activities are charged with a 0% tax (applicable in the case of financial services or medical services, for example);

- the import tax in Georgia is charged at the following rates: 0%, 5% and 12%;

- the excise tax in Georgia is charged based on the type of good that is imported or sold here and it can range from GEL 0.08 to GEL 800 per unit;

- the property tax is applicable at a rate of 1% from the value of the property;

- the land taxis calculated per each hectare of agricultural land and it ranges from GEL 5 to GEL 100.

Revocation of VAT registration in Georgia

Businesses operating in Georgia will no longer be liable to the payment of the VAT in specific conditions, as per the regulations of the Tax Code. There are several ways through which this obligation will be revoked and they refer to the following:

- a company will no longer be required to pay the VAT if it is involved in the liquidation procedures;

- he same is applicable when a legal entity enters the bankruptcy procedure, as stipulated by the Law of Georgia on Bankruptcy Proceedings.

The revocation is also applicable at the death of a natural person or when a taxpayer requests this through a written application, following the legal grounds under which the revocation can be granted. However, the manner in which this procedure can be handled is regulated by the Minister for Finance of Georgia.

Businessmen producing and trading excisable goods on the Georgian territory have to register for VAT purposes with the local tax authority prior to starting the supply of goods. Other conditions for registration may apply.

Our company incorporation agents in Georgia can tell you more about other cases in which VAT registration is compulsory. Also, we can help you submit the necessary documents for VAT registration with the Georgian tax authorities.

Once you will start a company in Georgia, you will also have VAT obligations, unless the company is exempted due to any of the reasons regulated by the tax legislation.

Our consultants can present what tax exemptions and tax deductions can apply to a Georgian business or to a foreign business that develops business activities that are taxable on the Georgian territory.

Foreign investors who will start a business in Georgia as an extension of a foreign company operating in another jurisdiction can be entitled to tax deductions that are regulated by the double tax treaties signed here.

In order to qualify, the country where the company is a tax resident must be one of the jurisdictions with which Georgia has signed a treaty for the avoidance of double taxation.

For advice on the double tax treaties available in Georgia, as well as the ways in which the provisions of the treaties can be applied to your business, we invite you to address to our team of accountants in Georgia.

Our team can explain the main tax benefits and the procedures that you must follow in order to obtain the respective benefits (usually, they refer to submitting documents with the tax authorities).

Businessmen who want to set up a company in Georgia in 2024 will most likely become VAT payers as well. Therefore, we welcome all businessmen to contact us for professional assistance on the tax procedures available in this country and the VAT obligations businesses will have in 2024.

Depending on the size of the company and its type, the law prescribes different procedures and regulations to be followed and our consultants can advise investors based on their investment plans.

Please know that our team can offer not only company formation services, but also professional services for other corporate matters once your company will start its activities in 2024 (tax advice, immigration, tax reporting, etc.).