The level of taxation applicable by the Georgian authorities represent one of the most advantageous in its region. Georgia benefits from low taxes, applicable to both companies and natural persons. It is important to know that the country applies only few types of taxes compared to other countries and it can also offer attractive tax regimes for foreign businessmen interested in investing in this country. If you are interested in company formation in Georgia, our experts can help you comply with the tax requirements.

| Quick Facts | |

|---|---|

| Legal framework of taxation in Georgia |

Tax Code of Georgia |

|

Taxation of income and profits |

Taxes apply to income received within the country, including profits made by local businesses from their activities. |

|

Corporate income tax rate |

– 15% (only applied when profits are distributed to shareholders), – 20% (for some financial institutions) |

| VAT rate |

18% |

| Personal income tax rate |

20% of income for Georgian tax residents |

| Withholding tax rate on dividends |

5% |

| Other taxes in Georgia |

– customs duties, – excise tax, – property tax, – land tax, etc. |

| Tax exemptions and exclusions |

– social security contributions, – capital gains tax, – wealth tax, – insurance tax, – stamp tax, etc. |

| Tax residency |

If someone spends more than 183 days in the country during 12 months. |

| Number of double taxation treaties | 58 (approx.) |

| Taxes for Free Industrial Zones companies |

Most taxes are exempt. |

| Tax number for legal entities |

YES |

| Georgian fiscal year |

Calendar year (January 1st – December 31st) |

| Investment incentives |

– foreign tax credit, – Free Industrial Zones incentives, – special trading company status, – incentives for international companies, etc. |

| Assistance |

Our partner accountants in Georgia can help with taxation matters. |

The Tax Code is the main rule of law which provides the legal framework regarding the taxation of natural persons and legal entities and it refers to local taxes and customs taxes as well.

The country’s main tax authority, which has the right to supervise the manner in which taxes are applied and collected here, is the Georgia Revenue Service.

Table of Contents

Taxes in Georgia

The taxes in Georgia are imposed to the income received from Georgian sources. In the case of Georgian businesses, the taxation is done based on the profits they obtain here from commercial activities. The taxes imposed in Georgia are presented below and our team of specialists in Georgian company formation can provide more details on each type of tax:

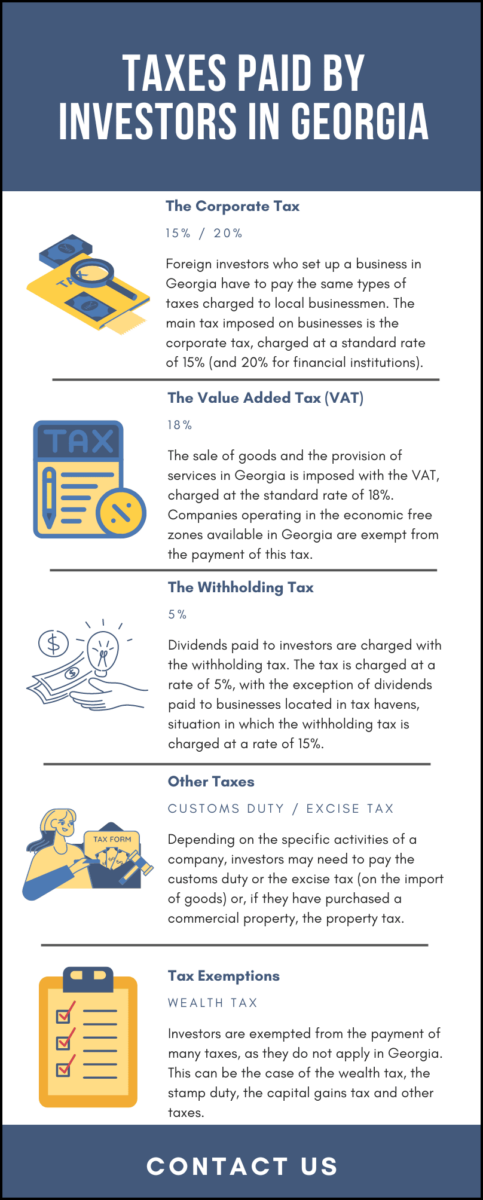

- the corporate income tax of 15% – payable only at the moment in which the company’s profit is distributed amongst the company’s shareholders;

- the value added tax of 18% – it is applicable to both the sale of goods and services available on the local market;

- the personal income tax – applicable at a rate of 20% on the person’s income, which is charged if the person is considered a resident in Georgia (after a period of stay in this country for at least 183 days);

- the import tax – this type of tax is charged with differentiated values of 0%, 5% or 12%;

- the property tax – is charged at a value of up to 1% from the value of the property.

A tax rate of 5% applies for dividends and interest. The property tax is levied on a local level while all other taxes are national. Georgia does not impose social security contributions, capital gains, wealth or insurance tax.

Individuals in Georgia are subject to the personal income tax levied on their Georgian-source income. An individual is a tax resident in Georgia if he or she spends more than 183 days in the country during a 12 month period.

Foreign investors in Georgia benefit from an extensive double tax treaty network signed with more than 50 countries. Georgia also has several Free Industrial Zones, which provide special tax rates and other benefits for companies which operate in specific economic sectors.

Our company registration agents in Georgia can help you with detailed information about taxation in Georgia, according to the type of company and business you perform.

Georgia’s secret to economic success lies in its low taxation and openness towards foreign investors. The country has been working on investing in key areas over the years and has never stopped encouraging business owners to open companies there. Our team of specialists in company formation in Georgia can advise on the main procedures foreign investors should follow when starting a local business.

The reforms imposed in the country lead to the creation of a favorable market environment and, thanks to this careful planning and attention, Georgia is the country of choice for investors in numerous business areas. While investing in Georgia may be facile, our Georgian company formation experts are qualified to assist and help you with information about taxation in Georgia and any legal or corporate issues.

What are the withholding taxes in Georgia?

The withholding tax in Georgia can be applied to both natural persons and legal entities developing taxable activities here. Thus, those opening a company in Georgia should be aware of the fact that they will be required to pay the withholding tax also, where applicable. Currently, the following withholding taxes scheme applies in this country:

- the withholding tax on wages is applied at a 20% rate, without calculating deductions;

- employees will pay a 2% contribution to the pension funds and the employer another 2%;

- in the case of non-resident entities, the withholding tax on services is applied at a rate of 10%;

- there is an exemption in the above mentioned case, in which the withholding tax is charged at a rate of 20% when renting a property;

- the withholding tax on dividends, interest and royalties payments are all charged with 5%;

- the payment of dividends, interest or royalties made by a Georgian taxpayer to an entity based in a tax-haven country is charged with 15%.

Ease of doing business in Georgia

Georgia is a country recognized for the ease of doing business as well as for its economic freedom. It also scores very well for lack of corruption and the public perception of the decrease in corruption is among the largest in the world.

One of the country’s greatest advantages for investors remains its low-tax regime. The country has implemented a three-phase tax reform that started in 2004 and ended in 2011.

With careful planning and by going through some essential steps, Georgia has managed to create an attractive taxation regime. Foreign investors who choose Georgia as their gateway to a number of important markets can request the specialized services of our Georgian company incorporation experts.

Tax reforms in Georgia

The first phase of the tax reform in Georgia took place between 2004 and 2007. The country began by fighting corruption and making some basic institutional changes. The second phase, from 2007 to 2009, aimed to improve institutional capacity and further reduce the tax burden.

The third and final phase, which took place between 2010 and 2011, began with a comprehensive policy reform and a reduction in tax compliance costs, among other measures for customs and other services. The total number of taxes in Georgia was reduced, over the years, from 21 to just 6.

The VAT rate dropped from 20% to 18% and the corporate tax also decreased from 20% to 15%. Moreover, Georgia managed to abolish social security contributions.

Tax compliance in Georgia

Any company in Georgia must be registered with the National Agency of Public Register of Georgia. After registration, a tax number is assigned to the legal entity. Tax returns in Georgia have due dates according to the type of tax.

Taxpayers can request an extension of the deadline for submitting the returns. Fines can apply for late payments. As a foreign business owner in Georgia, you may be liable to certain taxes, other that the corporate tax or the personal income tax.

The Republic of Georgia is a country that is constantly improving the taxation system and the rules and regulations for international executives in Georgia do not impose numerous taxes for the individual. Our Georgian company formation experts can help you understand taxation in Georgia and prepare a good tax planning strategy.

Taxes for an international assignee in Georgia

Georgia is a country that has a good geographical location and many foreign business owners open import companies or transport businesses here. As a non-native living and working in Georgia, you will have to pay certain taxes, and in most cases the income tax will apply.

Residents and non-residents in Georgia are only taxed on their income produced in Georgia. For this purpose, a resident is considered an individual who lives in Georgia for more than 183 days during one tax year.

If you own property in Georgia as a foreign business owner here, you will have to pay the real estate tax. This is applicable to buildings, constructions or parts thereof owned by an individual. The tax level is calculated according to the income level for one year.

For example, households that produce a total income per year below GEL 40,000 are exempt from the real property tax. The tax rates for other incomes range from 0.05% to 1% of the market value of the property. Corporate gifts in Georgia are exempt from taxes, provided that they have a value below GEL 1,000 and if they are not received by employers.

Gifts to first and second degree relatives are also tax exempt but those to other relatives are exempt only up to a certain amount. Our Georgian company formation experts can help you calculate and submit any tax returns.

Tax minimization methods

Tax minimization strategies can be applied both by small and large business owners. These strategies are different from tax evasion schemes in the sense that they are not illegal strategies for avoiding paying the due taxes.

Businesses can claim prepayments for certain expenses in advance. Another strategy is to maximize the amount of tax deductions in the current financial year with the purpose of reducing the taxable income. For example, purchase gifts for employees or business partners or make payments for business trips.

A strategy for tax minimization is using a trust to control the assets. This offers both tax effectiveness and asset protection. This strategy can be useful for high-income individuals or businesses in Georgia. Our Georgian company incorporation specialists can give you detailed information about these strategies and offer you alternative options.

What are the tax reporting formalities in Georgia?

Taxation in Georgia also includes all aspects related to tax reporting, which defines the legal procedures through which a legal entity (and persons – but most procedures refer to corporate entities), reports on its tax activity, income, expenses, revenues and other operating costs.

These are done so that the Georgian state will receive the amount of tax as established by the law, which is calculated as a percentage of the income of a business. The rates vary based on the type of income, the size of business, etc. Tax reports also take into consideration tax deductions and exemptions granted to certain entities.

Such benefits can be awarded following the rules of the law, and they can be granted for certain economic activities, for certain categories of companies, etc. All entities that have the tax residency in Georgia must complete their tax formalities during the fiscal year.

The fiscal year (or the reporting year/tax year) in Georgia is identical with the calendar year – 1st of January to 31st of December. Companies must prepare financial statements at the end of the financial year, but the actual submission of documents can be done few months later after the end of the calendar year.

This is regulated as such so that all entities have the necessary time to gather all the documentation and present the accurate financial image for that financial year. In Georgia, the deadline to submit the documentation is 31st of March of the following financial year.

Therefore, if you want to open a company in Georgia, you must make the necessary to steps to submit your documentation in due time, as the submission of documents at a later date could result in various penalties.

However, we also mention that companies must submit additional documentation throughout the financial year. The information presented above refers to the entire financial situation of the company, which is proven through the financial statements.

During the year, the company is required to submit corporate income tax reports on a monthly basis. The tax reports for each month must be submitted to the tax authorities by the 15th day of the next month. Bu that date, the company must also pay the corporate income tax due.

Our specialists in company incorporation in Georgia can offer more details on other reporting obligations imposed to companies.

Tax reporting for sole traders in Georgia

The rules for the submission of tax reports vary based on the legal entity structure of a company. Therefore, we mention that if you want to set up a business in Georgia as an individual, through a sole trader, the reporting procedures will vary.

For those who operate as a sole trader, the law states that they are required to submit estimated payments for the personal income tax they are liable to. These estimates must be made 4 times throughout the financial year, as follows:

- by 15th of May;

- by 15th of July;

- by 15th of September;

- by 15th of December.

What other reporting obligations are due on a monthly basis?

The legislation in Georgia imposes businesses of all types to submit various accounting documentation on a monthly basis. Most of the basic documents concerning taxes must be submitted on a monthly basis. Our accountants in Georgia have prepared a short list of these tax reports:

- the withholding tax on the salaries of employees;

- the withholding tax on dividends;

- the withholding tax on interest;

- the withholding tax on royalties;

- the value added tax report;

- the corporate income tax report.

There are other documents that need to be submitted, therefore we invite you to address our team of specialists in company formation in Georgia for an accurate presentation on the reporting obligations your company has, so that your company can enjoy all the benefits of taxation in this country.

Taxation in the free industrial zones in Georgia

Georgia has an important geographical advantage – its location near the Black Sea that makes is an alternative route to Central Asia. The free industrial zones were developed as part of a strategy to attract investors in Georgia and they are special areas located in key parts of the country, where an international enterprise can exist and benefit from special status regarding the taxation system.

The key is for this type of company to provide goods or services within a clearly defined free industrial zone. Our Georgian company formation experts can help you understand how business activities are conducted and regulated within these special investment zones.

Another business that benefits from incentives in Georgia is the so called free warehouse enterprise – a warehouse that has a confirmed special status and sells foreign goods. These establishments are exempt from profit tax on the income received from re-exporting.

It can be an attractive idea to open a company in Georgia in one of its free economic zones, considering that there are numerous advantages, not only in terms of taxation, but also from an operational viewpoint. Below, we have highlighted some of the main benefits of starting a business in a free economic zone:

- besides from the tax exemption on the corporate tax, investors are also exempted from the payment of the dividend tax;

- companies are exempted from the payment of the VAT, currently charged with 18% for all types of activities;

- the property tax is not applicable to free industrial zone businesses, and this also takes into consideration land taxes;

- when trading from a free economic zone in Georgia with a Georgian company, the tax applicable to the invoices between these company will be of only 4%;

- investors can benefit from a fast company formation procedure and low prices for utilities and electricity;

- the rental prices are also low and companies can benefit from reliable infrastructure, designed to meet the needs of a specific industry.

What are the investment incentives in Georgia?

One type of Georgian company that benefits from investment incentives is the international financial company. This type of financial institution conducts business with partners outside of Georgia and is located outside a free industrial zone.

Nevertheless, it benefits from exemptions from profit tax for the profit received from the provided services, the dividends paid and the gains derived by individuals who have sold securities issued by such a company.

Businessmen interested in company formation in Georgia must know that they can obtain specific tax advantages when working in the field of IT. For example, IT businesses providing their services in other countries can obtain a Virtual Zone Person Certificate, which will allow them to be exempted from the payment of the corporate income tax. This exemption can also be applied to dividends.

Investors can also be charged with lower tax rates provided that the company’s income will be below the GEL 500,000 threshold (or EUR 150,000). In this case, they can apply for a small business certificate, which will grant the right to be taxed on the yearly income with a tax of only 1%.

Our team of specialists in company formation in Georgia can present other types of incentives that can be offered to specific industries and can offer advice on how to register a local business.

It must be noted that numerous foreign investors prefer to start a business in this country because it has lower utilities costs compared to the average prices available in Europe. This is why foreign companies usually prefer to set up their manufacturing operations in Georgia.

Taxation for international workers in Georgia

It is not uncommon for international branches or subsidiaries, belonging to big corporations, to hire foreign employees in Georgia. Expatriates in Georgia are taxed only on their income that is produced in Georgia, as opposed to residents who are taxed on their worldwide income.

This can be advantageous for international executives in Georgia. The income tax rate is fixed at 20 percent, but there are some cases when the rate is only 5 percent. The cases in which this tax is lower include the type and source of the income and/or the status of the employee.

Our Georgian company incorporation experts can give you detailed information about the cases in which the exceptions for the lower rate apply. The personal income tax rate is fixed and does not depend on the total amount of the income received by the employee.

Special rules for expatriates in Georgia

When working in Georgia as a foreigner, an individual has to take some aspects into consideration. Short-term employees in Georgia (those who work in the country for less than one year) do not have to observe any special residency rules or mind any payroll considerations.

Non-residents working in Georgia still have to observe the same rules for filing tax returns as any other employee. For more information about taxes and tax compliance you can contact our team of agents in company formation in Georgia.

We can also advise natural persons who want to relocate here on the legal procedures and the documents that they should submit with the local institutions. If you arrive here with the intention to start a company in Georgia, you will need a business/investment visa. The visa pathway suitable for you will vary based on your investment.

Foreign businessmen can obtain permanent residency through certain visas. Our consultants can present the main options you have in this sense and what other rights you can obtain, such as relocating with family members.

One of the visas that grants the largest number of rights is the Golden Visa program, which requires an investment of GEL 300,000. Investors can qualify if they invest in the property market or if they start an economic activity in other sectors.

Thus, one can start a business in Georgia in almost all business sectors. This visa can be processed in a period of maximum 30 days. You can also contact us if you need information on other services that we can provide.

For instance, you must know that our accountants in Georgia are ready to provide professional accounting services for businesses and can also advise foreigners on their tax obligations as individuals, once relocated here, and this will imply that the foreigner should submit certain documents.